You are here

Back to topEuropean markets at a glance in the Fruit Logistica European Statistics Handbook 2019

When it comes to fruits and vegetables, Europe remains one of the most important markets worldwide. This is documented in the European Statistics Handbook 2019, published in conjunction with FRUIT LOGISTICA. The leading trade fair for the global fresh produce trade takes place from 6 to 8 February in Berlin. According to the new handbook, 42% the fruits and vegetables produced in Europe come from Spain and Italy. Trailing Germany with an annual volume of 8.5 million tonnes, the United Kingdom is the second largest importer with a volume of 6.5 million tons. Thus, it comes as no surprise that the fresh produce sector is eagerly following the Brexit debate. Another factor that had a significant impact on harvests and consumption was the extreme weather conditions in 2018.

The 2019 European Statistics Handbook, which can be downloaded from the FRUIT LOGISTICA website, provides a comprehensive overview of the most important European produce trading nations. Along with details on production volumes and information for import and export, the handbook outlines the unique characteristics and trends in specific markets.

Fresh produce totalling 103 million tonnes – including 47 million tonnes of fruit and 56 million tonnes of vegetables – was produced in Europe in 2018. Some 42% of this volume came from the two leading European countries: Spain and Italy. Trade with other countries accounted for 47 million tonnes imported and 37 million tonnes exported. The bottom line is a negative trade balance of more than EUR 12 billion.

European countries exported 2.47 million tonnes of apples and close to 2.64 million tonnes of oranges in 2018. Looking towards Asia, lucrative sales markets exist in the two most populous countries, India and China. However, import regulations primarily in the phytosanitary segment make it more difficult for European products to access the markets, especially in China. With political support, European trade associations are working full force to open up attractive Asian markets in countries including in China, Vietnam, South Korea and Taiwan.

The European fruit harvest in 2018 increased by around 9% over the previous year. Things looked even more optimistic at first, but unusually high summer temperatures prevented a record harvest for the year.

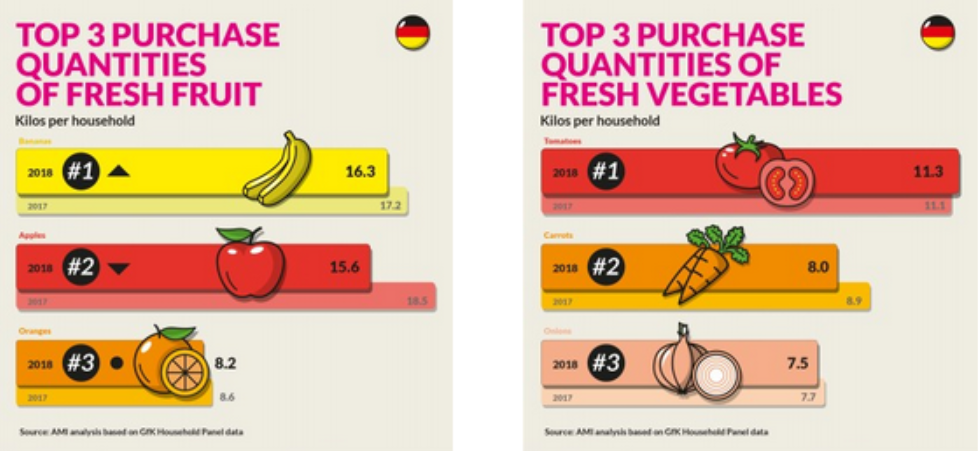

Vegetable harvests in the EU declined by around 7% with significant differences for individual products. There was a significant decrease in outdoor vegetables, including onions, carrots and potatoes. On the other hand, there was an increase in zucchini and other varieties that grow in hot climates. Production in weather-independent greenhouses also increased significantly.

Everyone has been talking about the weather. The effects of climate change are controversial, because hardly any other sector is as weather-dependent as the fresh produce business. This is not only true for harvests – temperatures also have an impact on consumption. For example, last year’s hot summer resulted in a double-digit increase in watermelon sales.

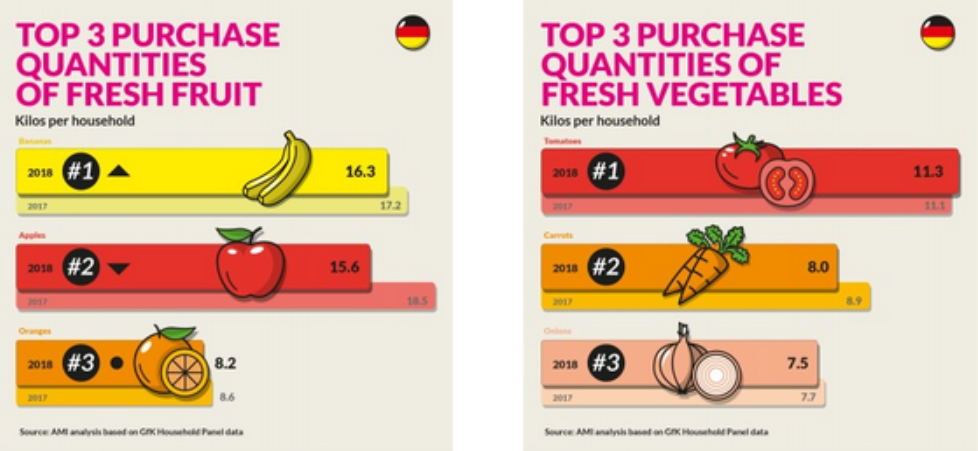

Looking at per-household purchasing volumes, apples ranked as the #1 fruit in most EU countries and tomatoes were at the top of the list in the vegetable category. Bananas were the most popular fruit in Germany and the UK in 2018. While German consumption of vegetables – especially tomatoes – is in line with the European trend, the UK, where carrots are the most commonly consumed vegetables, is an exception.

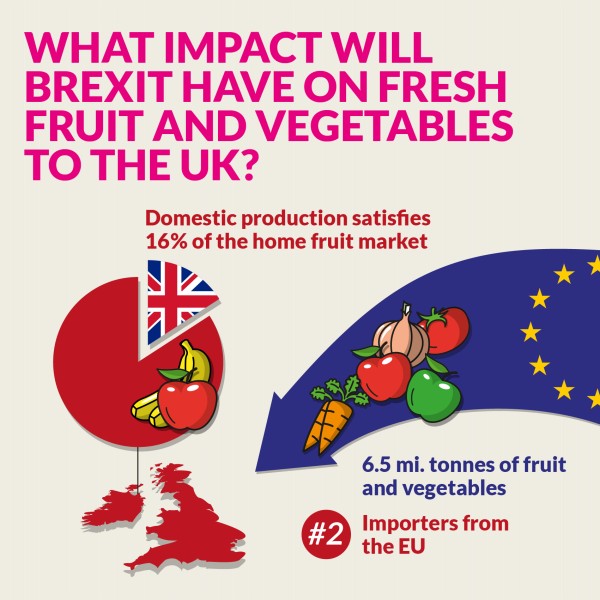

Although no one knows exactly how the upcoming Brexit will be regulated, the European Statistics Handbook offers a preview of the impact it could have on the fresh produce trade. Fruit and vegetable production in the UK is less than 2.5 million tonnes. While some 6.5 million tonnes are imported, the British fresh produce export volume of 0.3 million tonnes is negligible. This contributes to a negative trade balance of more than EUR 7 billion. Only 16% of the fruit consumed in Britain is produced in the UK. Consequently, the fresh produce industry is very concerned about the upcoming Brexit decisions.

Germany is by far the leading import market in the EU. The country imported 5.3 million tonnes of fruit and 3.2 million tonnes of vegetables in 2018. With a self-sufficiency rate of 38% for vegetables and 15% for fruit, Germany is heavily dependent on imports.

Germany is also statistically far ahead in the EU in another aspect. In the homeland of discount food outlets, more than half of all fruit and vegetables are sold by Aldi, Lidl and other similar retail outlets. Things are very different in France, where the market share held by discounters is very low and has recently declined even further.

The second edition of the European Statistics Handbook will be published in 2019 by FRUIT LOGISTICA in cooperation with Fruitnet Media International. This reference work covers production data, imports and exports in Belgium, Germany, France, Greece, Italy, Netherlands, Poland, Scandinavia, Spain and the UK. The current edition also analyses discount markets. All statistics were prepared and interpreted by Agrarmarkt Infomations-GmbH (AMI).

Add new comment