You are here

Back to topChile Optimistic for Cherry ‘Full Crop’ Scenario Over Next 5 Years

From August 31 to September 1, 2017, the China Chamber of Commerce of Foodstuffs and Native Produce (CCCFNA) and China Fruit Marketing Association (CFMA), in collaboration with the Shaanxi Fruit Industry Bureau, hosted the 2nd annual International Fruit Conference (IFC 2017) at the Intercontinental Hotel in Shanghai. Cherries took a prominent spot in the event, with the cherry-focused breakout session exploring China’s imported cherry market, as well as cherry production and trade in China, North America, and Chile. Alejandro García-Huidobro, General Manager at Exportadora Prize, delivered an in-depth presentation on the state of the Chilean cherry industry and gave an overview of current Chilean cherry production and trade, as well as a number of predictions as to possible future trends.

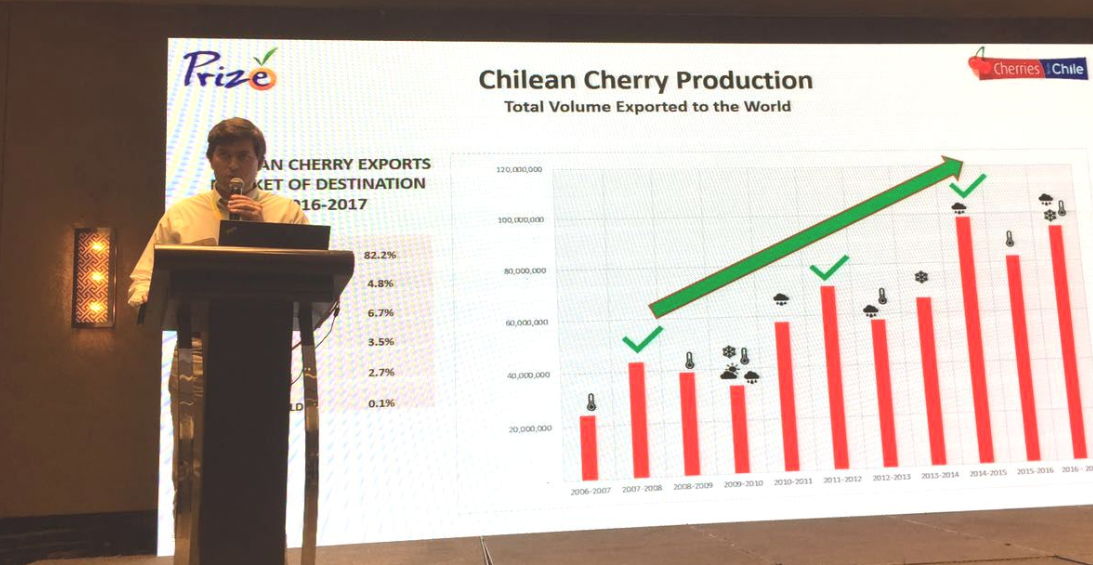

Mr. García-Huidobro began his presentation by admitting that it is quite difficult to accurately predict production volumes for cherries, as there are numerous climatic factors which can adversely affect growing conditions and production. In Chile, these factors are warm winters, or a lack of chill hours during winter, cold springs and frosts during such springs, and excessive rain during the summer and/or winter. Of these three factors, rain is the least concerning, as its negative affect on cherry growing conditions is less severe than the other two weather factors and certain practices have been implemented to address this problem, such as covering crops with nets and tarps or drying the crops by helicopter.

Over the past ten years, there have been three cherry growing seasons which have enjoyed ideal weather conditions and the ‘full crop scenario’ these conditions precipitated, but Mr. García-Huidobro stated that it was important for Chile to think, plan, and operate as if this ideal ‘full crop’ scenario was to be met each year over the next five years, as an unexpected glut in cherry production without sufficient resources for distribution or no market to export to would be an unwelcome surprise for Chilean growers and exporters.

In 2016-2017, Chile total cherry exports totaled 94,500 tons, or 18.9 million cherry cases. According to Mr. García-Huidobro, under the previously-mentioned ideal growing conditions, Chilean cherry exports are predicted to rise to 150,000 tons in 2017-2018, an increase of 58.7% over 2016-2017. Long term forecasts expect Chilean cherry exports to add 20,000 tons per season until it reaches 230,000 tons in 2021-2022. However, any forecasted growth in Chilean cherry exports is currently highly dependent on the strength of the Chinese imported cherry market.

Given that in the 2016-2017 season Chile accounted for 81% of China’s total cherry imports and that 82% of Chile’s global cherry exports were to China, the two countries are highly dependent on each for their respective cherry imports and exports and the health of these markets. Using the same growth metric of 58.7% for Chile’s cherry exports in the 2017-2018 season, Mr. García-Huidobro expects China to import 123,300 tons of cherries from Chile next year. China is also expected to retain its 82% share of Chile’s total cherry export market through to 2021-2022, when Chilean cherry exports to China are forecast to total 189,000 tons. However, there is the possibility that demand for imported cherries in China exceeds expectations, in which case exports to China could possibly account for fully 90% or more of global Chilean cherry exports.

The overall value of these imports is also projected to increase dramatically over the next five years. If exporters, importers, distributors, and most importantly Chinese retailers cooperate together and actively promote Chilean cherries in China via marketing campaigns, events, and other such activities, the overall value of sales of Chilean cherries in China could be increased by up to 60%, benefiting all parties involved. Mr. García-Huidobro predicted yearly increases in total retail sales value of 1.5 billion RMB every year over the next five years if such promotions are conducted. The cost of ‘doing nothing’ in 2017-2018 would be a loss of 1.35 billion RMB in the imported cherry wholesale market in China and a loss of 2.17 billion RMB in retail sales. By 2021-2022, this opportunity cost would balloon to 3.12 billion RMB in wholesale and 4.98 billion RMB in retail, making active promotion of imported Chilean cherries in China the ideal course to maximize value.

Assuming a ‘full crop’ scenario, Mr. García-Huidobro estimated that between 6,500 and 7,500 containers of Chilean cherries would be shipped to China in 2017-2018, with 5-10% of them sent via air and the remaining 90-95% by boat, which would include the use of ten ‘fast vessels’ for rapid ocean shipment to the ports of Hong Kong and Shanghai. There are expected to be four peak weeks, up from one to two in past seasons, with average container shipments during these peak weeks to reach 1,200 to 1,400 containers shipments per week. Even if climatic conditions prevent the realization of this ‘full crop’ growing scenario for Chilean cherries, marketing efforts and plans in Chile are to still be prepared as if ideal conditions were present. Despite the possibility of a non-ideal growing and climatic scenario, Mr. García-Huidobro remained highly optimistic as to the prospect of Chilean cherry exports in China in both the near and distant future.

Image Source: MZMC

Add new comment