You are here

Back to topBright Prospects for Macadamia Nuts in China

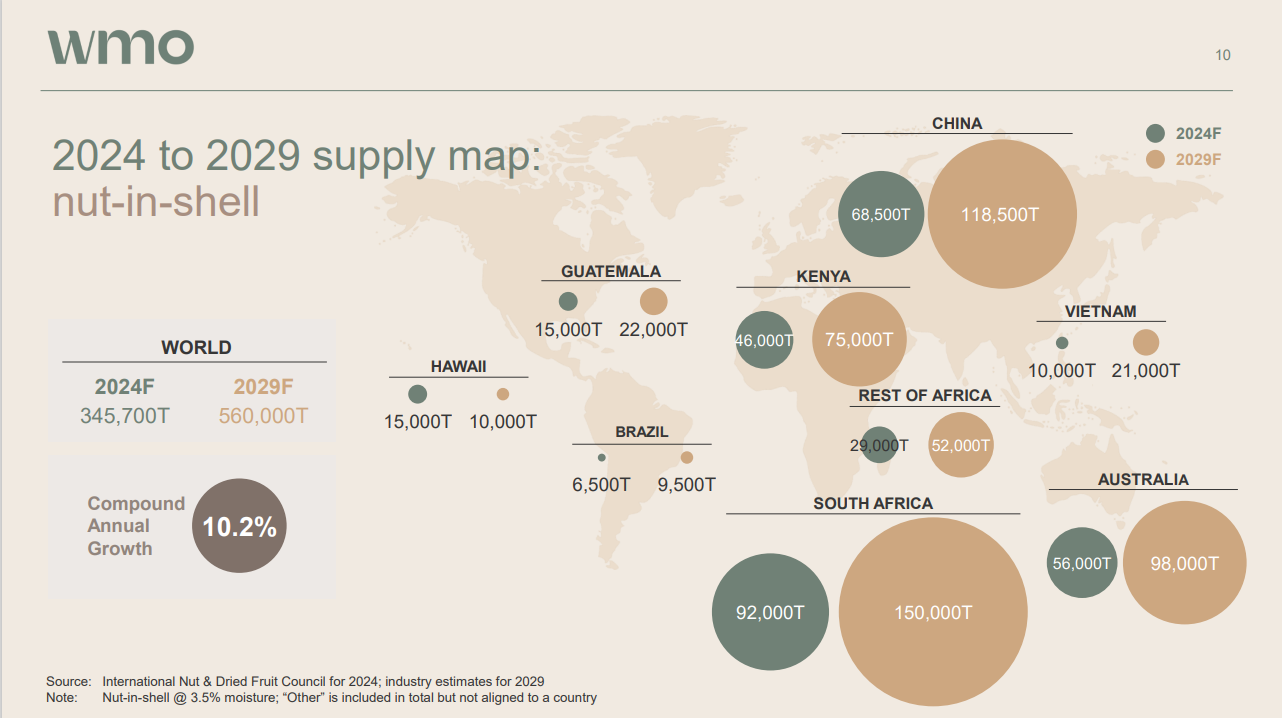

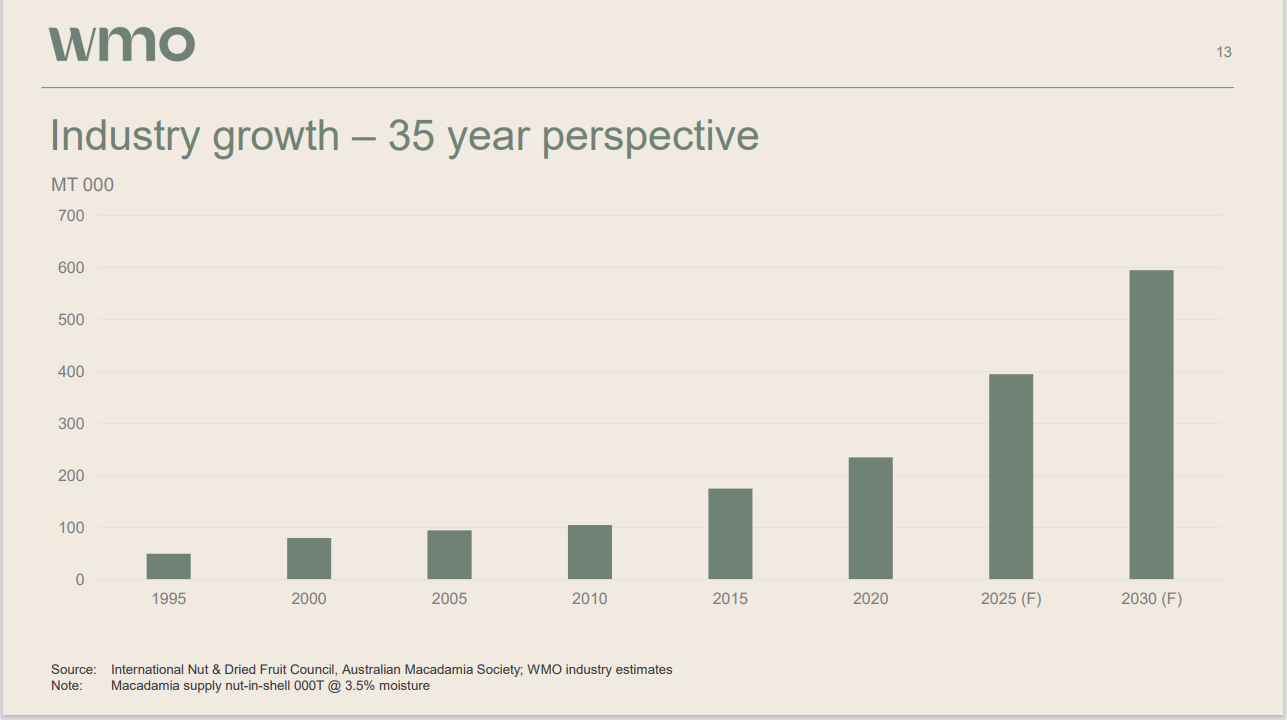

According to a recent forecast by the World Macadamia Organisation, global in-shell macadamia production is projected to approach 400,000 metric tons (3.5% moisture) by 2025, 560,000 metric tons by 2029 and nearly 600,000 metric tons by 2030. Over the next five years, the global macadamia industry is expected to maintain a rapid growth trend, with a compound annual growth rate of 10.2%.

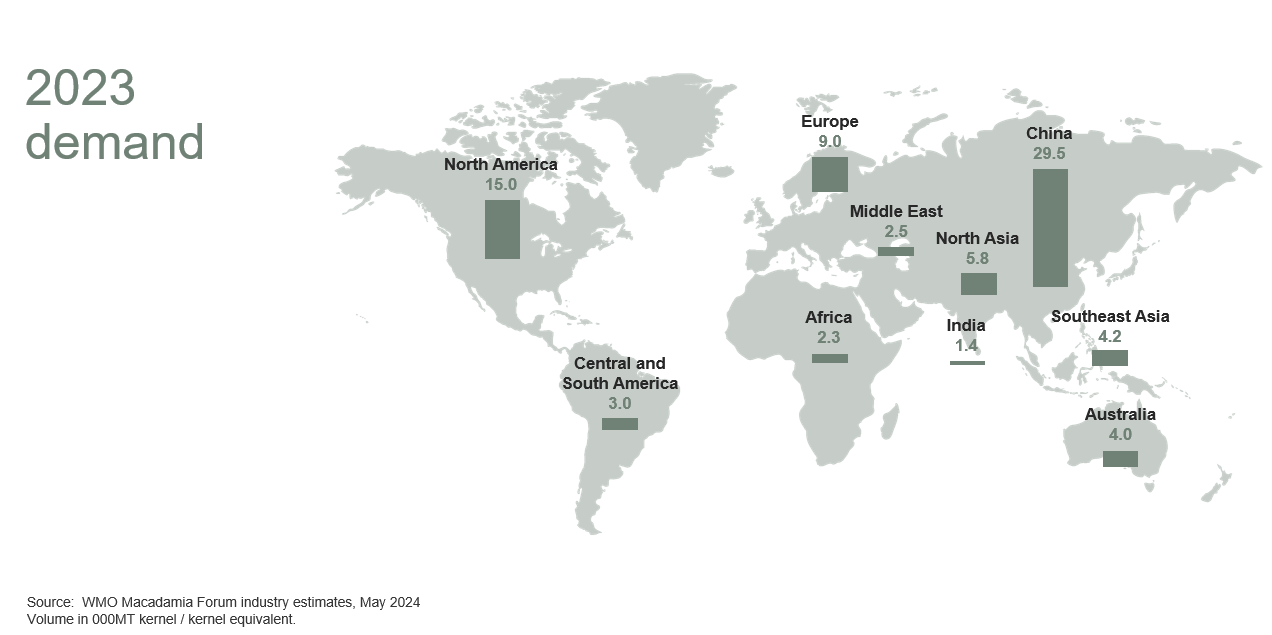

Meanwhile, global demand for macadamia nuts, measured on a kernel basis, was 64,000 metric tons in 2022 and is projected to rise to 137,000 metric tons by 2027, representing a more than twofold increase over five years.

China has played a crucial role in the rapid growth of global macadamia supply and demand. On the supply side, the numbers shared by China representatives at recent INC Congresses indicate that China’s macadamia production will increase to an estimated 118,500 metric tons by 2029.

On the demand side, China surpassed North America in 2022 to become the world’s largest market for macadamia consumption and is expected to maintain rapid growth over the next five years. According to industry estimates, China’s demand for macadamia nuts, measured on a kernel or kernel-equivalent basis, rose from 17,500 metric tons in 2022 to an impressive 29,500 metric tons in 2023. This marks a remarkable growth of nearly 70%, significantly surpassing earlier industry estimates of 20,300 metric tons for 2023. Furthermore, it is forecast that China’s demand for macadamia nuts will increase even further to reach 46,500 metric tons by 2027. This growth is expected to be driven primarily by three market segments: in-shell snacks, kernel snacks and food processing ingredients. Demand from these segments is projected to rise from 13,000 to 28,000 metric tons, from 1,000 to 8,000 metric tons and from 2,000 to 8,000 metric tons, respectively.

The WMO believes that the driving forces behind the rapid growth of macadamia consumption in China include the role of pricing in stimulating new opportunities, the development of innovative snacks, more distribution points and smaller pack sizes. The consumer occasions over the last three years have evolved from in-shell nuts in festival gift packs to more kernel offers targeting less formal and more individual snacking occasions.

According to data presented by Foshan Liushe Food Co. Ltd. (佛山市六社食品有限公司) at the 2024 China International Tree Nuts Conference, China’s macadamia cultivation area reached 345,000 hectares in 2024, with 280,000 hectares located in Yunnan province and the remainder primarily distributed across Guangxi and Guangdong provinces. China’s in-shell macadamia production (3.5% moisture) in 2023 was 67,900 metric tons according to data from the International Nut and Dried Fruit Council published in May 2024.

Data from the Guangdong Province Nuts Industry Association indicate that China’s import volume of in-shell macadamia nuts totaled 84,000 metric tons in 2023. It is forecast that China’s consumption of in-shell macadamia nuts will reach 150,000 metric tons in 2024, with imports accounting for 70,000 metric tons and domestic production contributing 80,000 metric tons. This year, macadamia nuts are priced higher on the Chinese market compared with last year. For instance, the typical farm gate price for in-shell nuts in the main producing regions is expected to rise to 9.5 Chinese yuan ($1.33) per kilogram, representing a 19% increase from 2023.

Currently, nut snacks account for approximately 20% of leisure food consumption in China, with the share of tree nuts steadily increasing. In 2023, the average daily consumption of nuts per consumer, measured on an in-shell basis, was around 10 grams, which is below the government’s recommended level. The consumption of nut snacks in China remains in its early stages.

Macadamia nut products in China can currently be categorized into several types: traditional in-shell nuts, which make up 50% of products; kernel products, representing 45%; and other forms, such as nut powders used in pastries and ice creams, accounting for 5%.

WMO market research indicates that various forms of macadamia kernels have become key offerings for leading food companies in recent years, valued for their “soft crunch” texture and rich creamy flavor. Macadamia nuts have strong nutritional backing, providing the high-quality fats necessary for a healthy diet while featuring a low glycemic index, as well as being a whole food from nature. However, many consumers remain unaware of the nutritional aspects of macadamia nuts, which means that there is both a need and an opportunity to shift consumer perceptions.

In China, Want Want Group has introduced macadamia milk and Chacha Food has launched a nut powder. Additionally, many other inventive snacks featuring macadamia nuts have emerged on the market.

Globally, innovations span more indulgent and more healthy offers. Indulgent applications include cookies, chocolates, ice creams and bakery products. More health-oriented new launches include snacking, breakfast occasion offers, dairy alternatives, oils and nut spreads. New mixed nut offers containing macadamia nuts are proving popular too.

Although in-shell nuts currently dominate macadamia consumption in China, ongoing innovation in nut snack flavors and diverse pairings of macadamia nuts with various ingredients will continually expand consumption scenarios, thereby driving overall sales of macadamia nuts.

Images: World Macadamia Organisation

This article was based on a Chinese article. Read the original article.

Add new comment