You are here

Back to topAustralia Poised To Be China’s Second-Largest Table Grape Supplier in 2023/24

According to the most recent Australia: Fresh Deciduous Fruit Annual report published by the U.S. Department of Agriculture’s Foreign Agricultural Service, Australia’s table grape production is expected to soar in marketing year 2024/25 on account of excellent weather conditions. Assuming these last until the end of harvesting, the total output in 2024/25 is forecast to reach 230,000 metric tons, a substantial 18% increase over the 195,000 metric tons estimated for 2023/24 and marking the second-largest output on record. The favorable weather conditions are also anticipated to boost grape quality and thus increase the supply suitable for export, driving the export volume up to 135,000 metric tons, the third-highest value on record.

Australia’s table grape industry grew rapidly for more than a decade after 2010, before being disrupted by the COVID-19 pandemic and the associated labor shortages and higher logistical costs. This situation was exacerbated by excessive rainfall in the spring and during harvest, affecting both output and fruit quality. Together these led to a reduction in industry returns and slowed down the rate of new plantings in recent years. Nevertheless, strong demand from Asian countries such as China has motivated growers to set their focus on new proprietary and export-oriented cultivars. Chinese consumers, for example, are rapidly shifting from seeded varieties such as Red Globe to seedless ones and are eager to try new varieties and flavors.

Australia’s table grape production in 2023/24 is estimated at 195,000 metric tons, significantly lower than a previous forecast of 220,000 metric tons. The lower-than-expected output is attributable to poor weather conditions, particularly during harvest, which not only affected fruit quality but also reduced the amount that could be harvested. Benefiting from a return to normal weather, production in 2024/25 is projected to rise to 230,000 metric tons, which, if achieved, would be close to the record of 233,000 metric tons registered in 2022/23.

Growers in key producing regions report that the bud burst this season is the best in years, indicating that production will be high. However, the actual output in 2024/25 will ultimately be determined by flowering and fruit setting in late October. It is worth noting that a rapid accumulation of chill hours and higher maximum temperatures this season caused bud burst to occur about two weeks earlier than in recent years. Additionally, moderate rainfall and warm temperatures contributed to lower disease incidence.

With respect to exports, it is anticipated that Australia will ship 135,000 metric tons of table grapes to global markets in 2024/25, a 26% increase over the downward-revised new estimate of 107,300 metric tons for 2023/24. If realized, this would be the industry’s third-best result on record, trailing only the export volumes registered in 2018/19 and 2019/20. Despite the fact that the two record seasons were only mediocre in terms of production, fruit quality and demand from overseas markets, particularly China, were both high, which boosted exports significantly.

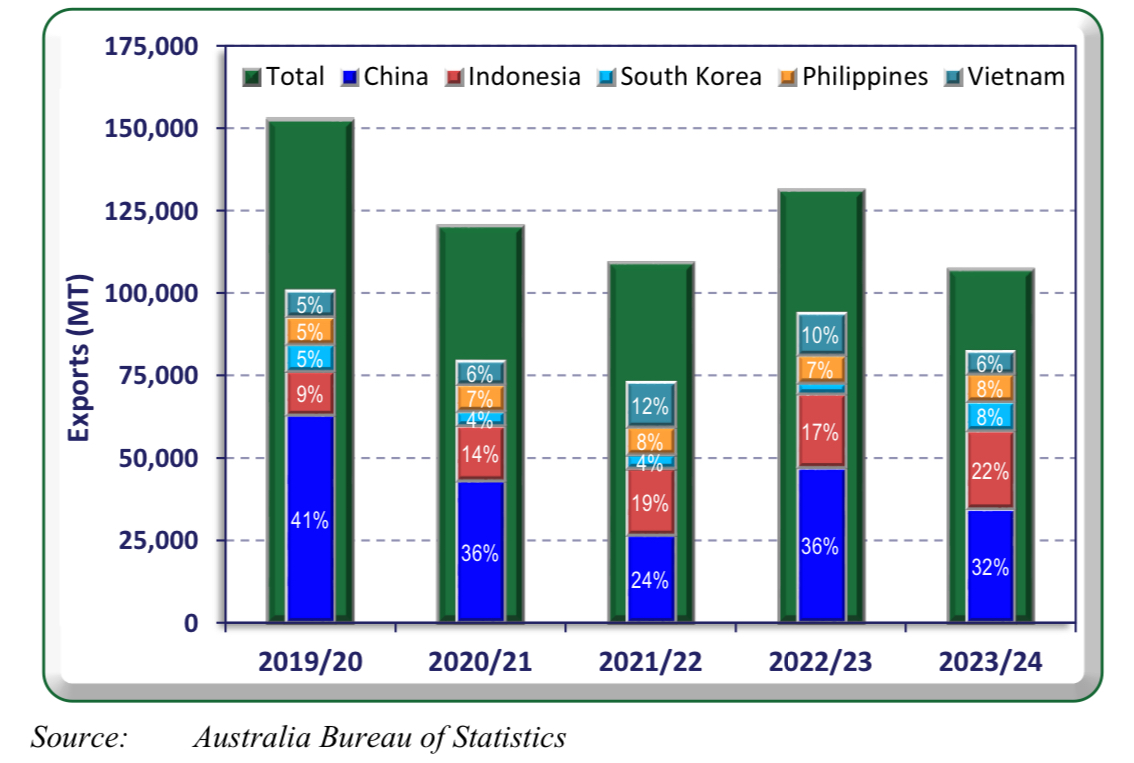

China has long been Australia’s main market for table grapes, accounting for one-quarter to over one-third of total exports. Indonesia, South Korea, the Philippines and Vietnam are among other major export destinations. Together, these five Asian countries absorb approximately 70% of total table grape shipments from Australia.

Despite the fact that China’s domestic table grape production has reduced the country’s import requirement by more than half over the past five years, it remains Australia’s key market for table grapes. According to industry insiders, Chinese retailers often store the fruit for up to six months in an effort to prolong the sales period for domestic grapes, but this can compromise the quality of fruit that reaches consumers.

Historically, over 90% of China’s imported table grapes originate from Chile, Peru and Australia. In recent years, however, Chile’s share has dropped significantly, from first to third place, as the country has focused on increasing its exports to the United States. As a result, based on currently available data from October 2023 to July 2024, Australia is expected to account for 31% of China’s table grape imports in the 2023/24 season, putting it in second place after Peru at 32%. Australia has a clear edge over South American countries in terms of geographical proximity to China, with sea shipping times of 18–20 days as opposed to approximately 35 days. Industry sources have suggested that as long as Australian growers prioritize the cultivation of proprietary varieties popular in China, they should be able to compete successfully with South American suppliers.

.jpg)

Images: Unsplash (main image), U.S. Department of Agriculture (body images)

This article was based on a Chinese article. Read the original article.

Add new comment