You are here

Back to topAsiafruit Congress Celebrates 20 Years of Development in Asian Markets

Chris White (left) and John Hey cut a ceremonial cake marking the 20th anniversary of the Asiafruit Congress

The Asiafruit Congress celebrated its 20th anniversary in Hong Kong today. The Congress is one of Asia’s leading forums for the global fruit industry to come together, and serves to open the Asia Fruit Logistica show, which runs from tomorrow through September 7.

The Congress welcoming remarks included John Hey, Editor of Asiafruit magazine, giving an overview of the past two decades of development in Asian fresh fruit markets since the first Asiafruit Congress in 1998, as well as some predictions about the future prospects for global suppliers in markets here. The conversation was led by Fruitnet Media Managing Director, Chris White.

“Over the past two decades, imports of fresh fruit by key Asian markets from both within Asia and outside Asia have more than doubled, increasing 140%,” from 4.9 million tons to 11.8 million tons said Hey. In Indonesia alone, imports have gone up 10 times from 60,000 to 670,000 tons over that period, according to Hey.

And although the growth in Asia has been significant, Hey sees reason to believe that growth in consumption of imported fruit in emerging Asian economies will continue into the future.

“Spending on fruits and vegetables in Asia is expected to account for more than half of the global spend (in terms of value) by 2030,” said Hey. Furthermore, “consumers in cities across China, Indonesia and India are still discovering imported fruits and are very much underserviced in their demand due to logistics and other issues. So there’s a great deal more room to expand the geographical reach.”

In terms of geographical scope in China, “we’re only scratching the surface of this consumer market,” said Hey. He later added that in China, fruit “imports are still only 1.5% of total consumption,” not including imports through Hong Kong. He pointed out that in Asian markets, “not only are imports a modest percentage of consumption, but Asian markets are still a modest percentage of total exports for the main [global] growers and buyers.”

Other key takeaways from the Asiafruit Congress opening session:

- China has undergone a shift from the 90s and early 2000s when most fruit entering the mainland flowed through grey channels from Hong Kong to Guangzhou, and the Chinese distributors, “spoke little to no English, had no knowledge of world markets or pricing…and they relied on the Hong Kong importers.” In recent years imported fresh fruit coming into mainland China has increasingly flowed through official ports of entry and modern, professional mainland-based importers and distributors now work closely with global producers, existing alongside a more traditional network of mainland wholesale markets.

- According to Hey, “Export growth has been even bigger than imports: exports to all destinations from key Asian markets, albeit mostly in and around Asia, have more than trebled, to reach 10.6 billion tons.”

- Many observers thought that supermarkets and hypermarkets would become the dominant retailers of fruit in many Asian markets, eclipsing traditional wet markets, with those formats being introduced in Hong Kong and Singapore in the late 90s and then being driven by the expansion of global chains into markets like China and Thailand in the mid-2000s. But that never really occurred, with a lot of growth in smaller domestically owned retail spaces like convenience stores and specialist fruit retailers, as well as online retailers.

- Now, especially in China, online and offline are converging with domestic companies the trailblazers in offering these experiences.

- The core of the Asian fruit trade, more than 60% of the trade, is still inter-Asian trading, with tropical fruits flowing north and temperate fruits flowing south.

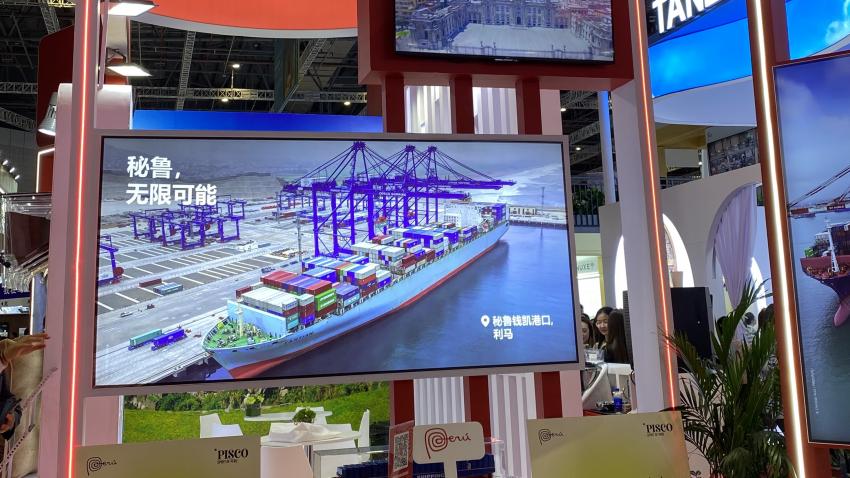

- The US remains the largest non-Asian supplier of fruit to Asian markets, with 18% of total supply of imported fruit to Asian markets, but growth of its exports to Asia has plateaued and faces strong competition. For other suppliers from outside of Asia, the strongest growth has been among South American counterseasonal suppliers like Peru and Chile. European exports to Asia have also been picking up.

- Asia has shifted from a place to sell supply “overspill” to a key part of oversea suppliers’ export strategies.

Delegates to this year’s 20th anniversary Asia Fruit Congress will receive the first copies of the 2018 edition of the Asiafruit Congress Statistics Handbook, which organizers say, “showcases trade trends across Asia in an easy to understand format.” According to Hey, the handbook, “includes 20-year comparisons so you can see what each of the 10 markets we cover in the stats handbook are importing now compared to what they imported 20 years ago.”

Add new comment