You are here

Back to topEntry of South African Avocados Set To Boost Consumption in China

The International Fresh Produce Association recently brought together representatives from the South African and Chinese avocado sectors in a webinar discussing the imminent commencement of South African avocado exports to China. The talks covered a variety of topics, including global avocado trade dynamics, an overview of the South African avocado industry with insights into key players, and an exploration of the market landscape for imported avocados in China.

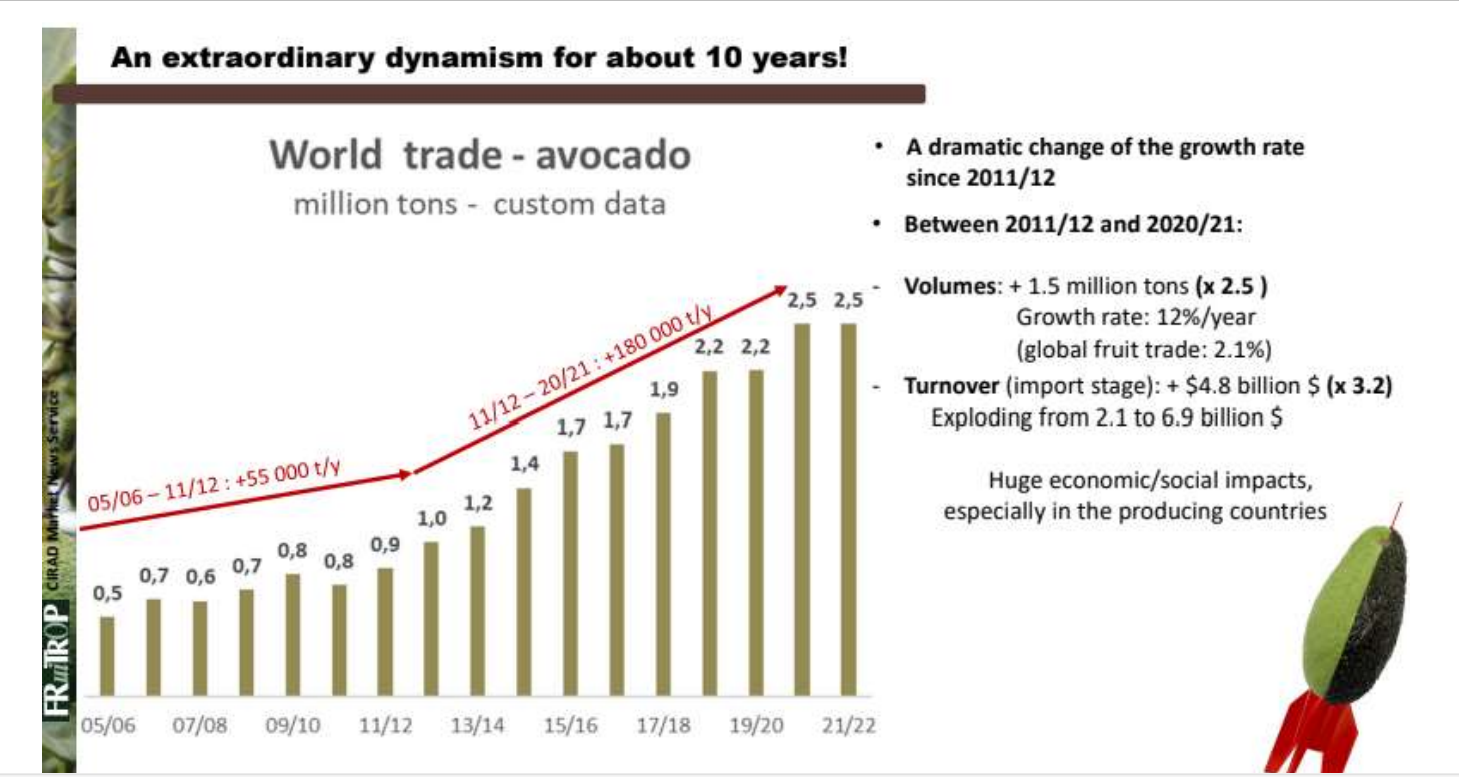

According to Clive Garrett, South Africa’s representative at the World Avocado Organization, the global avocado trade has experienced rapid growth in the past decade. In the 2021/22 season, global avocado exports reached 2.5 million metric tons and $6.9 billion, accounting for 3.6% and 8% of the global fruit trade in terms of volume and value, respectively. Over the decade since the 2011/12 season, the global avocado trade volume increased by 1.5 million metric tons with an annual growth rate of 12%, while the global fruit trade only witnessed a growth rate of 2.1% during the same period. Meanwhile, the value of the global avocado trade rose by $4.8 billion over this period, marking a 3.2-fold increase. Regarding the source of these exports, 82% of global avocado exports originated from Latin America in the 2021/22 season, while exports from the Mediterranean region and Africa each accounted for 6% of the total. As for the destinations, 80% of avocado imports were concentrated in the United States, the European Union and the United Kingdom. Notably, China ranked 18th globally in terms of per capita avocado consumption, indicating significant growth potential.

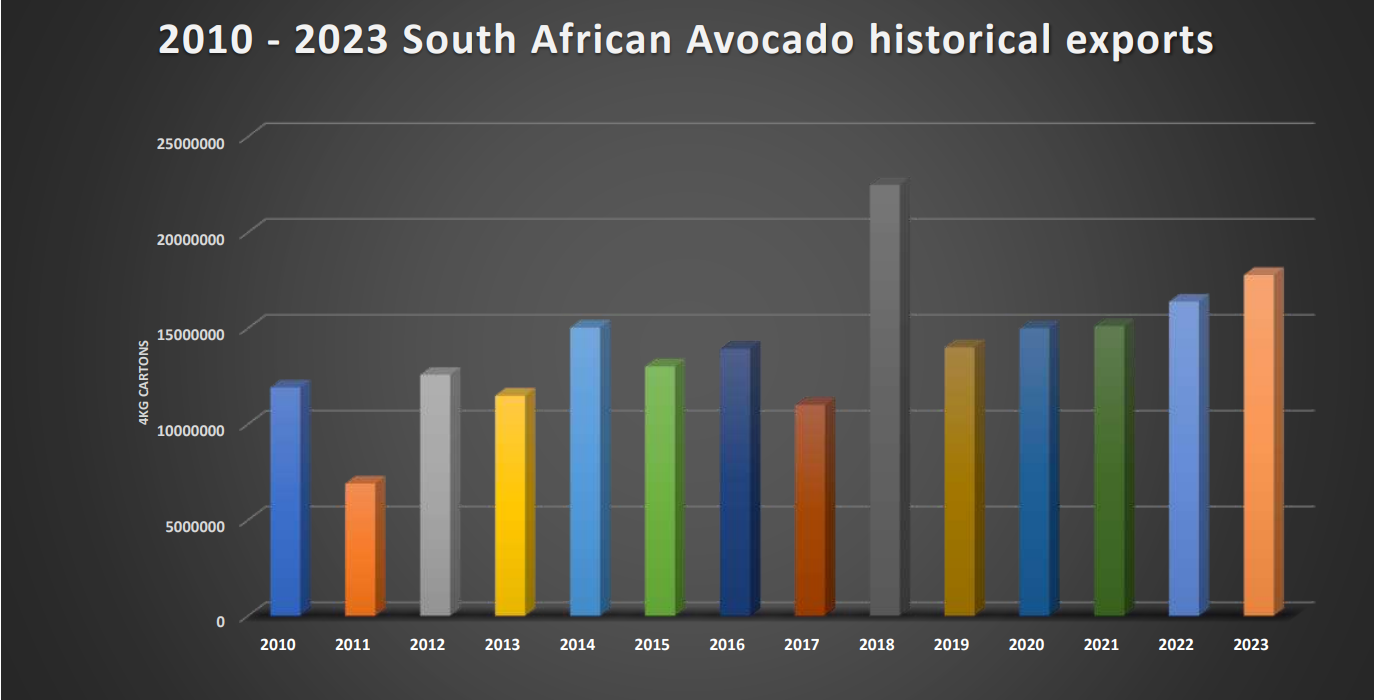

South Africa has an avocado cultivation area of approximately 19,091 hectares, which is primarily concentrated in the provinces of Limpopo, Mpumalanga and KwaZulu-Natal, accounting for 53%, 22% and 19% of the total planting area, respectively. Hass avocados dominate the production landscape, covering 51% of the total planting area. The Fuerte variety is the second most common, representing 20% of the total. Other significant cultivars include Pinkerton, Maluma Hass and Ryan. In 2018, South Africa’s avocado exports surpassed 20 million cartons (4-kilogram equivalent), setting a historical record, but the export volume subsequently began to decline. However, it has been steadily rebounding in recent years, surpassing 15 million cartons in both 2022 and 2023.

Regarding the development of China’s avocado market, Mabel Zhuang, China country manager at the IFPA, suggested that the sector may undergo certain changes with the introduction of South African avocados. Data collected by the IFPA indicate that China’s avocado imports stood at 32,627 metric tons in 2019. However, in the first nine months of 2023, they had already surged to 57,219 metric tons. Peru, Chile and Mexico are the top three avocado suppliers to China. The market share of Peru, the leading supplier, has consistently expanded, rising from 64% in 2022 to an impressive 84% in the first nine months of 2023. Meanwhile, the market shares of Chile and Mexico diminished from 24% and 7% to 6% and 3%, respectively. Since gaining market access to China in August 2022, Kenyan avocados have emerged as another significant player, securing a notable 6% market share alongside an impressive export value of $7.647 million to China in the first three quarters of 2023.

As to the Chinese market, the South African avocado industry holds a highly optimistic outlook. Trevor Dukes, CEO of Fruit Farm Group, emphasized the company’s extensive involvement in the South African avocado industry spanning nearly three decades. Fruit Farm Group has reportedly fostered strong partnerships with producers across diverse regions, enabling it to consistently supply avocados from February to December. The approval for exporting to China has opened up new avenues for the company, prompting plans to complete the upgrade of all packaging facilities by 2024. With advancements in supply chain management and other technologies, alongside a commitment to meeting Chinese requirements and a focus on quality, Dukes envisions that his company will gradually establish a positive reputation in China.

Garrett, who also serves as the marketing manager at South African produce company ZZ2, underscored another crucial advantage for the South African avocado industry, highlighting that the sea transportation timeframe from South Africa to China is nearly 20 days shorter than shipping from Peru. This notable reduction in transit time provides a significant competitive edge for South African avocados on the Chinese market.

Halls, a company with a century-long history in the fresh produce industry and a successful annual trading performance selling over 8 million cartons of avocados to more than 30 countries and regions worldwide, has also laid out its plans for exporting South African avocados to China. Roger Armitage, the company’s marketing director in South Africa, mentioned that as a fresh produce company originating from South Africa, Halls has a complete nursery-to-export industry chain in Africa. The company can reportedly provide avocados with diverse packaging solutions and ripeness levels according to specific customer needs. Following the recent granting of China market access, Halls has been actively preparing for avocado exports to China.

According to Lifan Yu, commercial manager at Halls China, the company has engaged in close collaboration with the Wanwei avocado ripening facility in Shanghai to guarantee the quality of imported avocados, ensuring that consumers receive perfectly ripe fruits. Yu revealed in an interview with Produce Report that Halls intends to start importing South African avocados at the beginning of the upcoming season.

From a retail perspective, the entry of a new player from Africa, characterized by a long production season and relatively close geographical proximity, is expected to further expand the market. Lynn Yang, South African products manager at Yonghui Superstores, is optimistic about the continued growth of China’s avocado import volume. This optimism is rooted in the increasing consumer awareness of avocados, particularly the demand for ready-to-eat avocados. At present, Yonghui’s annual sales of avocados amount to tens of millions of Chinese yuan, necessitating purchases from various countries throughout the year. The company anticipates that increasing consumer awareness in second- and third-tier cities will contribute to a further upswing in avocado sales.

According to Elena Huang, marketing manager at Shanghai Supafresh, the consumption of avocados is poised for further development. This positive trend is anticipated to be fueled by diverse retail channels, innovative ways of consuming the fruit and direct social media promotions tailored to consumers.

Images: Pixabay (main image), MZMC (body images)

This article was based on a Chinese article. Read the original article.

Add new comment